What are the factors affecting financial freedom?

What is financial freedom?Everyone is eager for financial freedom. What is financial freedom? Since it is finance, it is first related to income and assets.

Obviously, financial freedom is also related to consumption level.

Financial freedom is a measure of the relationship between "asset income" and "consumption level".

The core of "financial freedom" is freedom. For adults, what makes you not free? It's work!

But work takes up most of your time, you can't do things that you like.

Isn't the greatest lack of freedom in life "the contradiction between enjoying the time needed and the time occupied by work"? Isn't it the fear of losing your job that makes you suffer from the pain and boredom of work?

There is a simple formula to measure financial freedom:

Financial freedom=investment income ÷ consumption expenditure × 100%

"Investment income" represents the income generated by the family's financial capital (including bank deposits, securities accounts, monetary funds, etc.). "Consumption expenditure" refers to all expenditures for household consumption, including housing loans and car loans.

The meaning of this formula is: if you don't work, to what extent can you maintain your current living standard?

If you don't have any financial assets, your financial freedom is zero, which means that once you lose your job, you can hardly maintain your current living conditions.

When your financial freedom reaches more than 100%, the significance of work in making a living will be greatly reduced. You naturally pay more attention to the sense of achievement and value of your work, which are higher level life pursuits.

From the perspective of financial freedom formula, financial freedom depends on three factors: one is the accumulated financial assets, the second one is the investment income ability, and the third one is the consumption level.

Because the level of investment income needs to be improved slowly, the consumption level is relatively more rigid, and the most significant factor is financial assets.

Financial assets are an accumulated quantity, and their sources include two parts: the first part is the surplus of working income minus living consumption expenditure, which is positively related to income level and negatively related to consumption level.

Of course, in order to achieve financial freedom as soon as possible, it is not a good way to excessively reduce the consumption level. Financial freedom is to make life comfortable, and the natural consumption level cannot be too low.

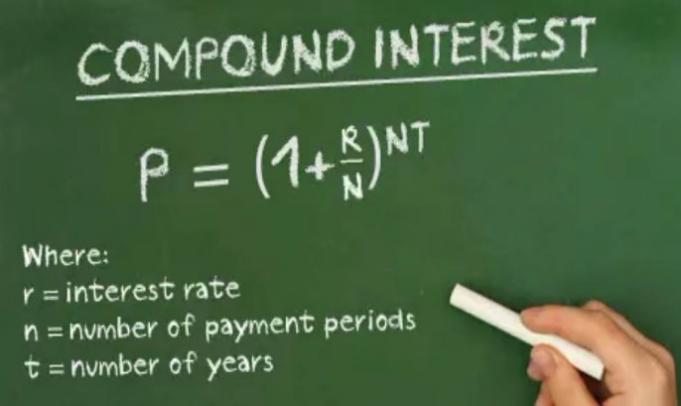

The second source of financial assets is the income reinvestment part, which is easy to be ignored, but this is the most important "compound interest principle" in investment. The factors that determine this part include investment capital, return rate, adherence to investment and risk control. After long-term accumulation, the proportion of this part will be far higher than the principal of the first part.

Few people can get high income once they enter the workplace, so the accumulation of financial assets mainly depends on:

1. Revenue growth rate

2. Balance between savings and consumption

3. Insist on investment in the principle of compound interest

Only financial freedom that does not spend too much time and energy to achieve can be regarded as real financial freedom.

The yield requirement of compound interest is not very high, but it needs stability and risk control. Without the contribution of compound interest, it is difficult to meet the requirements of financial assets.