How long is the long-term investment?

Stocks are the assets with the highest long-term returns.

Then, how long is "long-term"? How long do we need to stick to the long-term investment?

As long as the target is not selected too badly. The longer the investment time is, the higher the investment profit is.

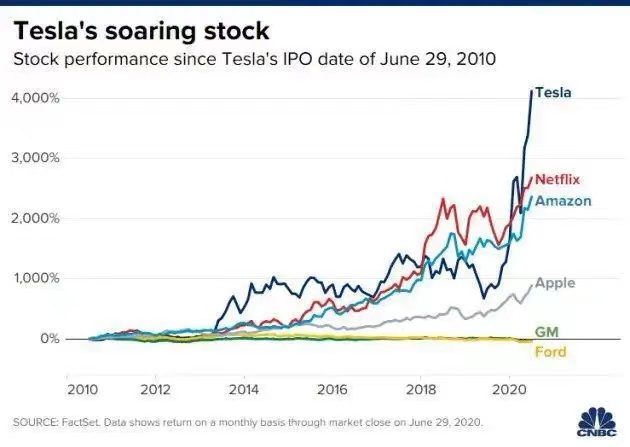

Nowadays, as we all know, the stock prices of good companies are not linear. They tend to remain dormant for many years, and then achieve major gains in a short period of one or two years.

Although the stock price will also rise in the dormant period, this curve is more like a feeling of " quantitative cause a qualitative change". If you look at Tesla's price curve, the trend is more obvious.

Previously, some scholars calculated the returns of investing in the S&P 500 index for 20 years from 1996 to 2015:

If you hold stocks during this period, the return is about 4.8% per year;

If you miss the five days with the largest increase in the past 20 years, your return will drop to 2.7% per year;

If you miss 10 days with the largest increase, your return will become 1.3% per year like the bank deposit;

If you miss 40 days unfortunately, your return will be -4% per year.

Whether for the market or for individual stocks, we are tired of waiting most of the time. The real rise and fall only occur in a short time. In other words, waiting is quite painful, and so many people will choose to sell and then go after new hot spots.

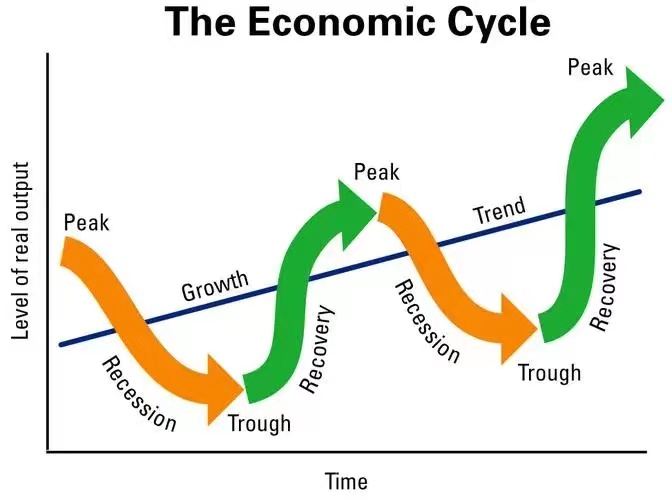

Another important aspect of the difficulty of long-term investment is that the market always rotates.

The rotation here refers to the rotation of asset performance, the rotation of investment style, or the rotation of industry sectors.

If we look back at history, we will find that the performance of the US stock market in the 1970s and 1980s is totally different. In the 1970s, the United States experienced a series of crisis events, such as the escalation of the Vietnam War, the collapse of the Bretton Woods System, the Middle East oil crisis and so on. From the end of 1969 to the end of 1979, the Dow Jones Industrial Index and the S&P 500 Index rose and fell, and barely rose after ten years. If inflation is included, it is even a loss.

The Federal Reserve has controlled inflation, and the technology level has improved significantly. In the 1980s, the S&P 500 index rose 2.2 times. This range is similar to that of the 10-year bull market from 2009 to 2019 in US.

When we ask how long we invest in the stock market, the real problem behind it may be that we don't want to get rich when we get old.

The income we get from investment is related to these three factors: principal, time and earning rate.

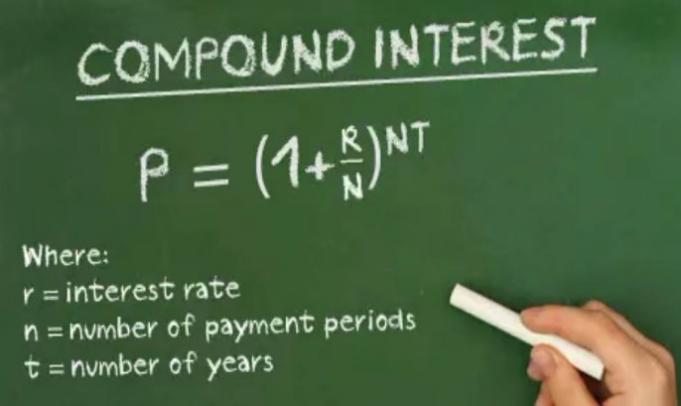

Income=principal × (1+earning rate) ^ Time

The only thing we can control is the principal of the investment.

Therefore, it may be more important for us to eliminate anxiety, focus on work and life and make more money. At the same time, we should do a good job in asset allocation and improve the earning rate within a reasonable range.