What is risk cognition? Risk cognition refers to the individual's feeling and understanding of various external risks.

For example, for the same stock assets, the stock fund managers who have studied it very deeply may think that its risk is not great, and the risk of devaluing it by putting money in deposit will be greater.

On the contrary, if you are awed by the short-term rise and unable to predict the market so as to earn profits in short-term speculation, you may get high returns in three to five years.

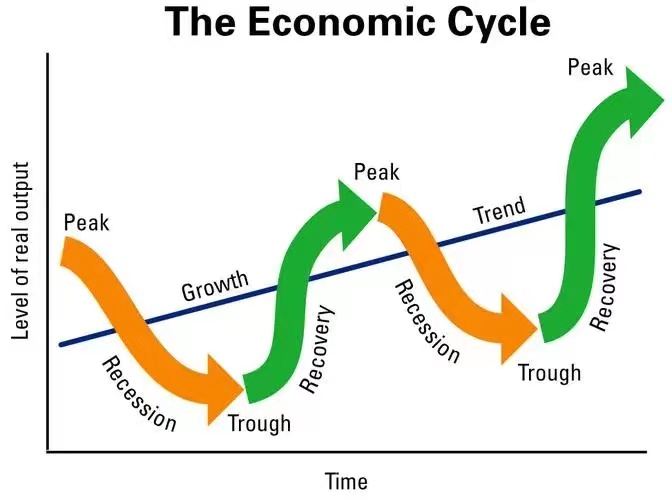

Many uncertain short-term events become probable or even inevitable events in the long term. As for the stock market, the long-term upward trend is unchanged, so we stick to long-term investment, asset allocation and fixed investment. In this way, we will feel that the risk of stock market fluctuations is less.

Similarly, when it comes to entrepreneurship, people may think that entrepreneurship is risky, especially in bad economic environment. But if we are prepared for long-term entrepreneurship, just like the long-term holding of stock funds, we are still iterating on ourselves in the process of entrepreneurship to make ourselves better assets.

What is risk attitude?

Risk attitude is the degree of investors' preference for risk. By behavioral economics and investor psychology, we can make the evaluation results of investors' risk attitude.

Different people have different attitudes towards risk. Some people may like stimulation, while others may prefer stability. Investors can be divided into risk avoiders, risk pursuers and risk neutrals according to their preference for risk.

Risk avoiders: risk avoiders prefer assets with low risk.

Risk pursuers: contrary to risk avoiders, risk pursuers usually actively pursue risks and prefer the volatility of returns rather than the stability of returns.

Risk neutral person: risk neutral person usually neither avoids risks nor actively pursues risks. Their criteria for selecting assets are the expected returns, regardless of the risk profile.

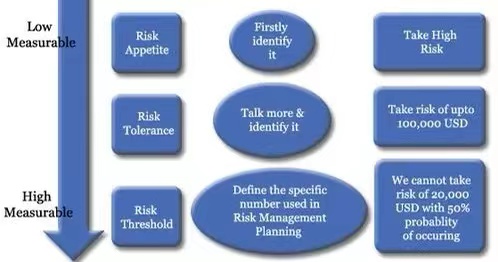

What is risk tolerance?

Risk tolerance is the ability of investors to bear the maximum volatility after rational decision. The fluctuation includes both decline and rise. It is the ability that investors make rational decisions. It is not the direct answer to questions such as "how long will you be willing to bear the maximum loss of investment".

Because it is likely that investors can not accurately tell their tolerance before they have experienced bull and bear markets. Compared with risk attitude, in the field of investment, preference is not a preference for risk, but a preference for income. Unfortunately, there is risk along with income.

Therefore, compared with the risk attitude, risk tolerance is closer to the risk appetite we need to know. We can understand that every investor is risk averse, and the risk tolerance represents the maximum price that he is willing to pay for gain.

Young people may have higher risk tolerance than older people because young people have various possibilities. In addition to age, investment experience, income, educational background, attitude towards setbacks are different dimensions to measure investors' risk tolerance.