On the way to financial freedom, there is always a view that financial freedom can only be achieved if there is a large amount of initial principal, and it is impossible without start-up capital.

For example, "Financial freedom must have the first start-up fund. If you don’t have initial principal, it’s very lucky when you are 30 years old with half a million dollars."

In fact, the significance of the initial principal for financial freedom is overestimated. We can also achieve financial freedom without it.

The threshold of financial freedom is that our passive income exceeds our family expenditure, and exceeds our working income later. Let us free ourselves from the situation of "have to work" mentally, which does not require much money actually.

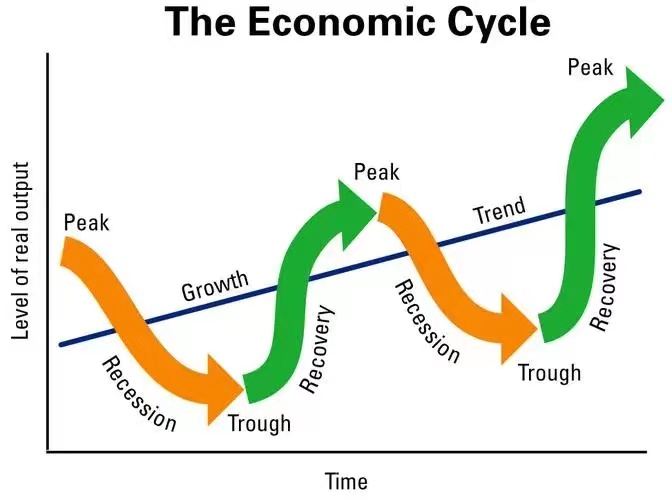

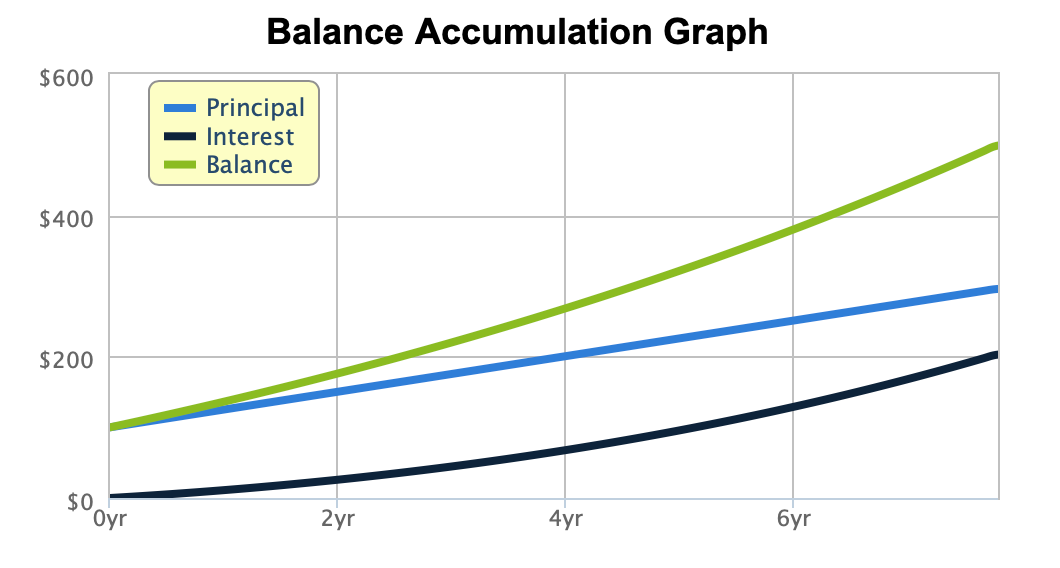

If we start the financial freedom plan from the very beginning, we are willing to save half of our income every year to invest and accumulate the principal, and keep the benefits at 10% annualized yield. In 7 years, our passive income will exceed our living expenses. In another 4 years, our working income will be exceeded. This is not an impossible goal.

Don't let the concept of initial principal limit you.

Moreover, promotion and salary increased are not considered in the above calculation. If this part is also included, the impact of the initial principal will be smaller. Therefore, many people will find that the actual time required is shorter than expected after they embark on the road of financial freedom.

In contrast, more attention should be paid to how to increase income, how to save money and how to invest.

If we are willing to double our income while still maintaining the previous spending level, the time we need will be shortened from 7 years to 3 years.

On the contrary, if we can only save 20% of our income each year, the time required will change from 7 years to 17 years.

If we don't spend some time to study investment and are only satisfied with 5% annualized yield, the time for financial freedom will double again. At that time, we have reached the retirement age.

If we are lucky to get the initial principal, we must make good use of it. It is easier to earn the next 1 million with 1 million.

But the first pot of gold is not very important, because financial freedom is a free road without luck.

It is not money that affects people's direction, but people define the value of money.

Instead of sitting there waiting for the initial principal to change our destiny, can we change ourselves first and redefine the real value of our "initial principal" ?

The initial principal is not very important, but we ourselves. We can start from the very beginning, start make a financial plan and then take action, and we can also achieve financial freedom one day.