Howard Max, a famous investor, made a statistics in the 《Cycle》. Max said that he had experienced a complete 47 years (1970~2016) in the investment industry. During this period, the annual growth rate of the US S&P 500 index was 10%. This is a very reasonable number.

If the annual return is 10%, we can assume that the annual return of 8%~12% should be considered as a "reasonable" range. How many years of returns are in this range in the past 47 years? Max said that he guessed that the number would not be large before the specific calculation, but the actual answer was still surprising to him - in 47 years of history, only three years of returns were within this range. In other words, it is within this range for the US stock market to have only one year every 16 years.

There is an another interesting statistic that has little to do with investment. By 2020, how many of thousands of matches does James achieve 27+7+7?

The answer is: zero.

Why does the market always have big fluctuations, even extreme bull and bear market?

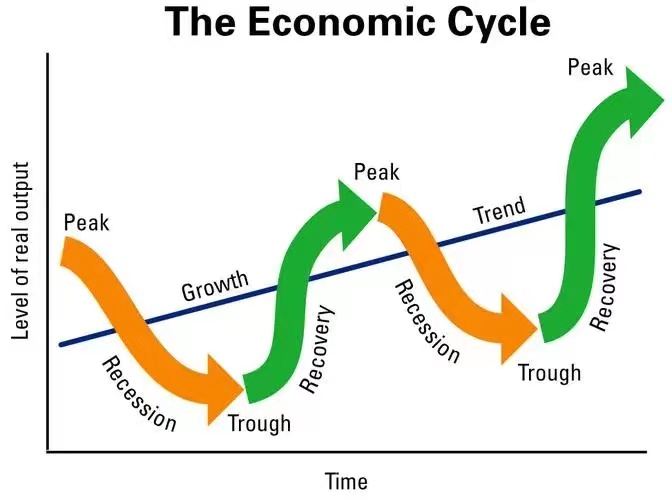

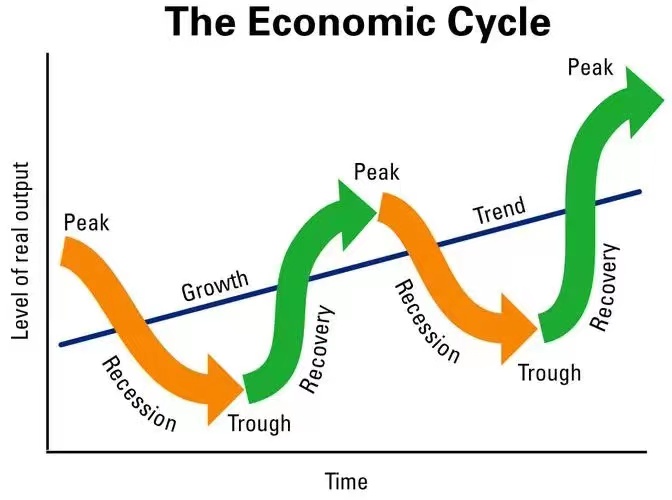

From macroscopic view, the market cycle is mainly determined by three cycles - economic cycle, corporate profit cycle and emotional cycle.

The long-term economic development of an economy is usually determined by these factors as birth rate, labor productivity, and scientific and technological development.

In addition to operating leverage, enterprises usually face the impact of financial leverage. We all know that enterprises usually borrow money and need to pay interest every year.

Apart from the direct impact of GDP changes on enterprises, such as operating leverage and financial leverage, these factors will change the profit cycle of enterprises significantly. When we value the stock market and companies, profit is often the most important reference indicator. Therefore, the ups and downs of the profit cycle also makes a great contribution to the ups and downs of the whole market.

In fact, neither of these two cycles has a greater impact on market volatility than the last one - that is, the emotional cycle.

The market is the sum of participants' behaviors and changes people's minds, which leads to extreme changes in the market.

When the economic situation is good, entrepreneurs invest in reproduction blindly. The credit easing of banks and other financial institutions in the economic upturn cycle also encourage this behavior, which further magnifies the profits of enterprises.

Reflecting on the market cycle - the media are all good news, and the corporate profits have exceeded expectations repeatedly. At this time, investors' psychology and emotions take over the scene. They think that such a scene will last, so the stocks price surge.

At some time, a certain factor causes the company's earnings to be less than expected. At this time, the final receiver has also entered the market, so the stock market begin to fall. The operating and financial leverage in a good economic situation become a burden for enterprises, and the profits of enterprises decrease rapidly.

The stock market falls further and there is bad news to spread. Investors believe that such a scene will continue and the economy is about to end, so they sell their stocks. Enterprises cut jobs and investors' wealth shrinks. Everyone reduce unnecessary consumption, and the income and profits of enterprises decrease... until the next cycle begins.