A common question of fund investors is, "Is there a good fund to recommend?". It seems that you can make money steadily with a good fund. Is that true?

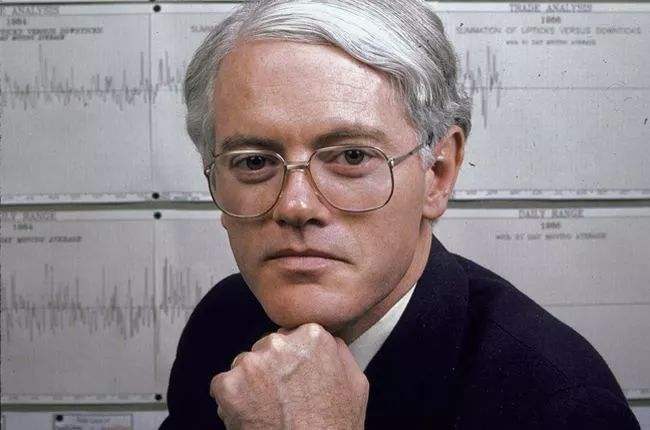

As we all know, Peter Lynch is an outstanding stock investor and fund manager. He was the vice chairman of Fidelity. Data shows that the average return of investors who have invested in the Magellan Fund of Peter Lynch is negative.

It is one thing whether a fund earns high yield, but it is another thing whether you can make money from it.

Most investors invest a fund that they are interested, but if we want to earn high yield from a fund, we need to rely on trust.

As long as the fund or fund manager has attractive highlights, you like this fund very much. I trust you and I’m willing to get along with you.". But when this fund loses money, we are always ready to leave.

Recognize the fund you chose and reject other options for the fund or fund manager.

Because I know that profits and losses come from the same source. It is always such a group of people who can seize the opportunity to make much money.

It is not only about investing and making money, but also trust is the foundation of financial freedom. If you don't even have a fund manager you really trust, how can you enjoy financial freedom?

Behind trust is the recognition of values.

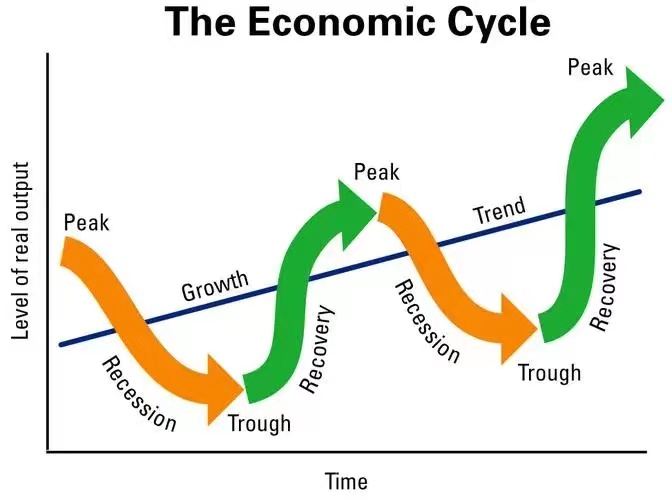

No matter what method an investor adopts, he will inevitably face lagging performance in some periods. No matter what investment method an investor chooses, it is not how brilliant this method is when it is brilliant, but when this method fails in stages, he can still face it calmly.

This way depends on the character and values of investors.

Behind making money is holding the fund, behind holding is trust, and behind trust is mutual recognition of values. The key to understanding values is to think in reverse and know when your investment will be "tragic".

It is not as difficult as you think to select a good fund that can get high yield.

First, find the funds that have been established for more than ten years, and then find the funds with good historical performance and a stable fund manager. Although we can't guarantee that everything is reliable, the proportion of reliable is significantly higher than the market average level.

But this is just the beginning that is the first step of the long journey.

Second, you need to study and understand when this fund manager will be unlucky or even be spurned. Because any long-term effective strategy will inevitably have short-term failure.

Third, accept and trust everything your fund manager does. When others begin to leave, you can stand firmly with the fund manager together.

In this way, you will not be far away from sustainable earning and financial freedom.