The volatility of the stock market magnified our emotions. But it is likely that we have been tossing about for a long time, and the impact on the overall assets is negligible.

The long-term investment performance of an investor is affected by many factors, such as investor behavior, asset allocation, transaction cost, stock or fund selection, etc.

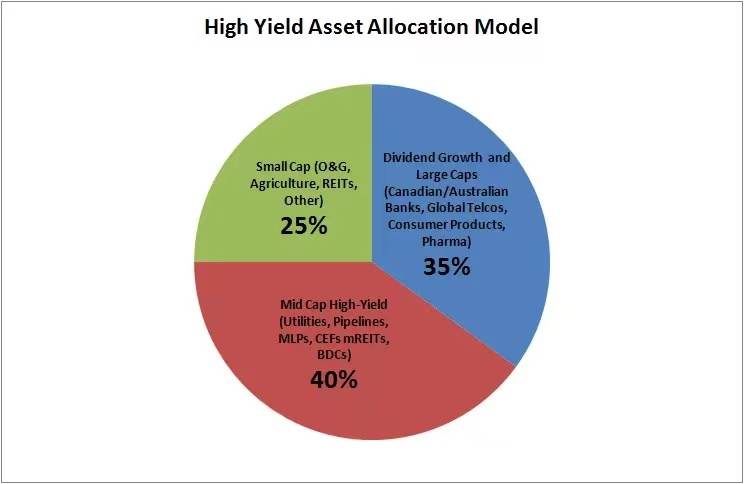

Asset allocation determines most of benefits. Asset allocation is the first thing we should consider when we make investments.

For most of us, the first thing to configure is your real estate and financial assets.

If your assets are allocated in many real estates and few financial assets, this asset allocation may not be reasonable. It may be more important for you to adjust the proportion of real estate and configurable financial assets rather than which fund or stock you should choose.

But if you have more than one house, you may consider dispersing some equity assets such as stocks and funds. Make your asset allocation more reasonable, and have a greater probability to enjoy the rise of future assets.

How to allocate financial assets?

Traditionally, no matter what in banks or other financial institutions, when they help us allocate assets, they usually use questionnaires. This type of questionnaire usually contains many questions, such as "What is your annual income?" "If the assets fall by 30%, can you bear it?". Then we determine our risk appetite according to the results of this questionnaire, and then determine what proportion of cash, bonds, and stocks we should allocate.

The meaning of risk assessment itself is to know the bottom line of our risk tolerance. Because this bottom line has left some room for decline in our hearts. In this space, we can tolerate the pain caused by the fall, so that we can stick to it for a long time.

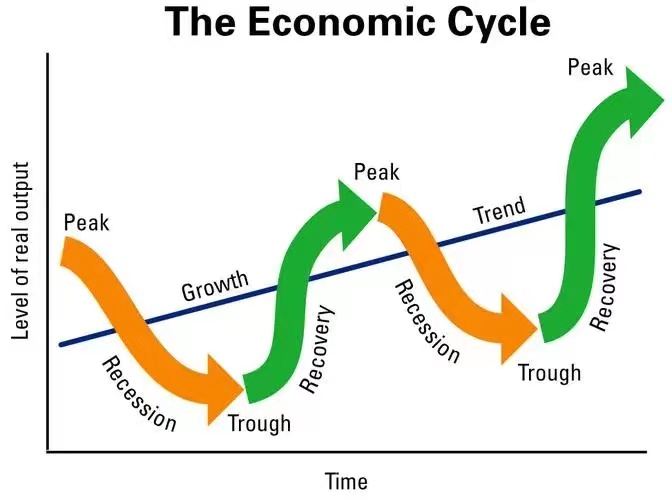

The stock returns can reach 20%, but we never know when the 20% occurs. Therefore, the longer we stick to it, the more likely we gain rich profits.

When filling out the questionnaire in a bull market, everyone feels that a 30% drop is completely bearable. But when it came to a bear market, even if it is only 15%, you may have been very panicked.

In addition, it is easy to fill in a 30% drop in the risk assessment questionnaire, but you can easily underestimate the impact of a real 30% drop on your psychology.

In our practical observation, most investors lose money because of "passive selling", or because of allocating short-term money to the stock market, or because of fear of falling. On the one hand, we can choose good investment products to minimize the withdrawal and loss in the process of market fluctuation. On the other hand, we can minimize the operation of following others.

The investment proportion is not an accurate figure, but a psychological control. The mentality and behaviors can also affect our long-term profits.