After we get monthly salary and annual bonus, in addition to saving in the bank, what else way can we make money?

Investment is not only for making money, but also for better life. Therefore, we need to plan our own money before answering this question. Money for different purposes is invested in different ways.

In real life, we can allocate our money according to insurance, financial management and long-term investment.

If investments are offensive, then the insurance is defensive.

There are so many uncertainties in life that we can't avoid risks completely, but we can make some efforts to reduce financial troubles when we face unexpected situations.

Different life stages have different insurance needs. We can consider whether we need to configure serious disease insurance, life insurance, cancer insurance and other types of insurance. Generally speaking, accident insurance and medical insurance are cheap and practical. If we meet the insurance conditions, they are suitable for most people.

There are two types money. One is used for our daily expenses, such as purchasing necessities, paying rent, housing loans or paying credit cards. The other is to deal with the money that is needed at any time and save 3-6 months' salary as an emergency reserve fund, which can make us more leisurely when we have unexpected expenses.

We do not expect this money to earn high profits. More importantly, it’s safe and convenient, and it can be able to take it out quickly when it is needed.

Monetary Fund can be redeemed at any time and the probability of loss is very low. Although the income is not high, it can get some income stably.

If there are some planned expenses in the next 1-3 years, such as buying a car, buying a house, getting married and having children, traveling, etc. Or we don't want to bear too high investment risks and we have no pursuit of high investment returns.

The characteristic of this money is that it will not be used in a short period of time, and we pursue higher returns than savings.

Therefore, stable financial products are very suitable and they are mainly invested in medium and low risk bond assets, which increases the possibility of obtaining better returns because they are stable.

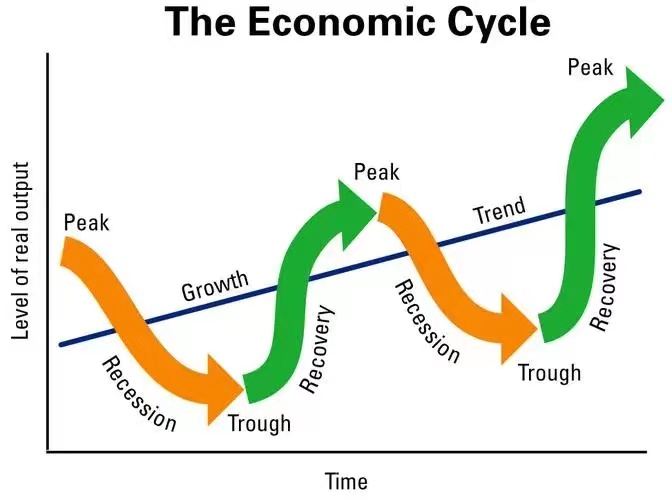

Long term investments are mainly invested in the stock market. The stock market has a long cycle and big short-term fluctuations, so we need to use long-term money to invest.

Select index funds that represent long-term economic growth.Ultimately, we are more likely to get good returns.

Before investing, we need to reasonably plan our money according to different purposes and risk preferences. Compared with pursuing high returns blindly, matching money with investment products is more important.